[ad_1]

Recap for November 16

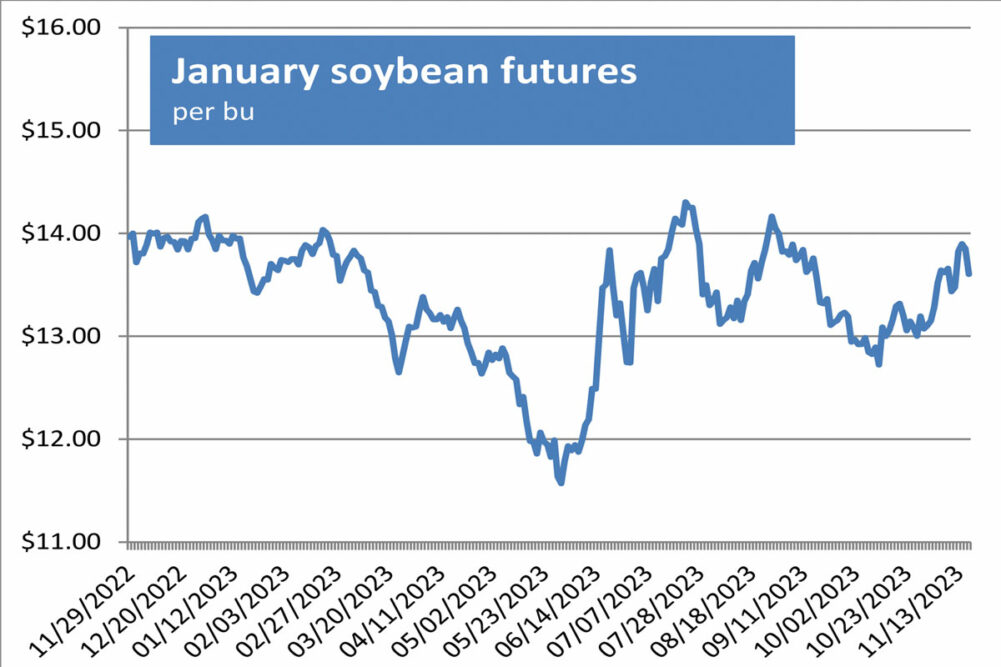

- Rainy Brazilian forecasts and the possibility of downpours that could offset the export competitor’s recent hot, dry weather weighed on soybean futures Thursday. Corn dipped early in the session but closed slightly higher. Wheat futures were lower, down 1.25% to two-week lows in the case of Chicago soft red winter wheat, on weak demand. December corn futures added 4¢ to close at $4.74¾ per bu. Chicago December wheat dropped 7¢ to close at $5.53½ per bu. Kansas City December wheat dropped 12½¢ to close at $6.27¼ per bu. Minneapolis December wheat fell 9¼¢ to close at $7.26 per bu. January soybeans tumbled 24¾¢ to close at $13.60¼ per bu. December soybean meal eased $2.40 to close at $466.80 per ton. December soybean oil lost 1.42¢ to close at 51.63¢ a lb.

- US equity markets were mixed, the S&P 500 and Nasdaq edging higher while the DJIA dipped under pressure from earnings selloffs on such shares as Cisco Systems and Walmart. The Dow Jones Industrial Average dropped 45.74 points, or 0.13%, to close at 34,945.47. The Standard & Poor’s 500 edged up 5.36 points, or 0.12%, to close at 4,508.24. The Nasdaq Composite edged up 9.84 points, or 0.07%, to close at 14,113.67.

- US crude oil prices were lower Thursday. The December West Texas Intermediate light, sweet crude future was down $3.76 at $72.90 per barrel.

- The US dollar index reverted to its recent downside slide Thursday after a one-day reprieve Wednesday.

- US gold futures jumped as the dollar dipped Thursday. The December contract added $23 to close at $1,987.30 per oz.

Recap for November 15

- Soybean futures fell back Wednesday after touching the highest levels since August a day earlier. Pressure came from an improved Brazilian weather outlook that boosted supply prospects and overshadowed demand from record US soybean crushings in October. Brazil’s rain forecasts also depressed US corn futures, offsetting support from signs of good export demand for US supplies. US wheat futures were mostly lower alongside declining European wheat futures after France’s agriculture department increased its forecasts for soft wheat exports and wheat ending stocks. December corn futures slumped 7½¢ to close at $4.70¾ per bu. Chicago December wheat dropped 11½¢ to close at $5.60½ per bu. Kansas City December wheat closed unchanged at $6.39¾ per bu, but later months declined in a 3¢ range. Minneapolis December wheat eased ¾¢ to close at $7.35¼ per bu. January soybeans dipped 4¾¢ to close at $13.85 per bu; August 2024 was steady, but September and beyond edged higher. December soybean meal shed $4.40 to close at $469.20 per ton. December soybean oil rose 0.30¢ to close at 53.05¢ a lb.

- Further evidence that the economy was cooling at a gradual pace boosted US equity markets for a second day on Wednesday. A Labor Department report indicated producer prices fell 0.5% in October from the previous month, the largest single-month decline since April 2020. Retail sales fell 0.1% over the same period, the first decline since March. The Dow Jones Industrial Average added 163.51 points, or 0.47% to close at 34,991.21. The Standard & Poor’s 500 edged up 7.18 points, or 0.16%, to close at 4,502.88. The Nasdaq Composite edged up 9.45 points, or 0.07%, to close at 14,103.84.

- US crude oil prices were lower Wednesday. The December West Texas Intermediate light, sweet crude future was down $1.60 at $76.66 per barrel while the January contract fell $1.38 to close at $76.79.

- After a four-day downslide, the US dollar index posted a higher close Wednesday.

- US gold futures dropped alongside a newly ascendant dollar Wednesday. The December contract lost $2.20 to close at $1,964.30 per oz.

Recap for November 14

- US soymeal futures rallied to contract highs Tuesday, helping soybean futures pop to their highest price since August on concerns about unfavorable crop weather in top supplier Brazil, which also helped corn futures close higher. Wheat futures were mixed, spring wheat higher while winter wheat contracts declined despite an unexpected decline in crop conditions a day earlier. December corn futures added 1¢ to close at $4.78¼ per bu. Chicago December wheat fell 7¢ to close at $5.72 per bu. Kansas City December wheat dropped 1¾¢ to close at $6.39¾ per bu. Minneapolis December wheat added 5¾¢ to close at $7.34½ per bu. January soybeans edged up ¾¢ to close at $13.68¾ per bu. December soybean meal added $4.50 to close at $473.60 per ton; the May contract and beyond were lower. December soybean oil rose 1.21¢ to close at 52.75¢ a lb.

- Inflation cooled more than expected, according to a Labor Department report today, fueling ideas the Federal Reserve will end its historic rate-raising campaign and igniting big gains in stocks and government bonds Tuesday. The report indicated consumer prices overall were flat last month and rose 3.2% from a year earlier, slower than in September. Increases in core prices, which exclude volatile food and energy items, also continued cooling, indicating underlying price pressures are dying down. Core inflation for the five months ended in October was at a 2.8% annual rate, down from 5.1% during the first five months of the year. Overall inflation peaked at 9.1% in June 2022. The Dow Jones Industrial Average soared 489.83 points higher, or 1.43%, to close at 34,827.70. The Standard & Poor’s 500 added 84.15 points, or 1.91%, to close at 4,495.70. The Nasdaq Composite jumped 326.64 points, or 2.37%, to close at 14,094.38.

- US crude oil prices were unchanged to higher Tuesday. The December West Texas Intermediate light, sweet crude future was steady at $78.26 per barrel while the January contract eased 2¢ to close at $78.17.

- The US dollar index was lower Tuesday for a fourth consecutive day.

- US gold futures continued higher Tuesday. The December contract gained $16.30 to close at $1,966.50 per oz.

Recap for November 13

- Soybean futures soared Monday as China continued last week’s string of soybean purchases and on weather-model forecasts that the northern two-thirds of Brazil will experience temperatures near 100 degrees in the coming days, threatening the crop in the world’s top exporting country. Corn futures rallied off last week’s nearly-three-year low on technical trading and with support from an export sale to Mexico. Wheat futures edged higher, except for the spot Minneapolis contract, on expectations winter wheat conditions would be steady after the crop’s best start in years. Dry conditions remain a worry in the southern Plains, and the USDA’s Crop Progress report issued after the market closed indicated conditions worsened in several hard red winter states, but mostly improved in the soft red wheat Central states as of Nov. 12. December corn futures added 13¼¢ to close at $4.77¼ per bu. Chicago December wheat added 3¾¢ to close at $5.79 per bu. Kansas City December wheat gained 1½¢ to close at $6.41½ per bu. Minneapolis December wheat pulled back 1¾¢ to close at $7.28¾ per bu, but subsequent contracts were mostly higher in a 2¢ a bu range. January soybeans soared 35¢ to close at $13.82½ per bu. December soybean meal added $19.70 to close at $469.10 per ton. December soybean oil rose 0.34¢ to close at 51.54¢ a lb.

- US equity indexes posted mixed closes Monday. Among the majors, only the Dow industrials posted an increase on the back of rising Boeing shares after that company received a large order for jets. The wider market tracked bond market movement where at one point the yield on the benchmark 10-year US Treasury note reached as high as 4.696%, up from roughly 4.5% less than a week ago, before eventually settling at 4.631%, compared with 4.627% Friday. The Dow Jones Industrial Average added 54.77 points, or 0.16%, to close at 34,337.87. The Standard & Poor’s 500 eased 3.69 points, or 0.08%, to close at 4,411.55. The Nasdaq Composite dropped 30.36 points, or 0.22%, to close at 13,767.74.

- US crude oil prices rose again Monday. The December West Texas Intermediate light, sweet crude future closed $1.09 higher at $78.26 per barrel.

- The US dollar index opened the week with a second straight loss after a four-day rally last week.

- US gold futures rose as the dollar faltered. The December contract ascended $12.50 to close at $1,950.20 per oz.

Recap for November 10

- Corn futures declined to near three-year lows Friday and posted a third straight weekly loss a day after the USDA raised its estimate for the US 2023-24 corn crop to a record 15.234 billion bus from 15.064 billion in October. Wheat futures followed corn lower as traders digested Thursday reports seen as bearish for wheat. Technical buying sent soybean futures mostly higher. December corn futures dropped 4¢ to close at $4.64 per bu. Chicago December wheat fell 5½¢ to close at $5.75¼ per bu. Kansas City December wheat dropped 7¼¢ to close at $6.40 per bu. Minneapolis December wheat pulled back 4¢ to close at $7.30½ per bu. November soybeans added 5¾¢ to close at $13.33½ per bu. December soybean meal dropped 50¢ to close at $449.40 per ton. December soybean oil rose 0.75¢ to close at 51.20¢ a lb.

- On the heels of Thursday’s declines, US stock indexes pulled higher Friday, the Nasdaq posting its best day in more than five months and the S&P 500’s 11 sectors all closing higher. All three posted weekly gains. Also, the bond market stabilized with the benchmark 10-year Treasury yield settling at 4.627%, from 4.629% the day prior. The Dow Jones Industrial Average soared 391.16 points, or 1.15%, to close at 34,283.10. The Standard & Poor’s 500 added 67.89 points, or 1.56%, to close at 4,415.24. The Nasdaq Composite added 276.66 points, or 2.05%, to close at 13,798.11.

- US crude oil prices rose again Friday. The December West Texas Intermediate light, sweet crude future closed $1.43 higher at $77.17.

- The US dollar index closed the week with a loss after a four-day rally.

- US gold futures reverted to the low side Friday. The December contract tumbled $32.10 to close at $1,937.70 per oz.

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |

[ad_2]

Source link